ezPaycheck Troubleshooting: FUTA and SUTA Issue

ezPaycheck payroll software makes it easy to calculate federal and state payroll tax.

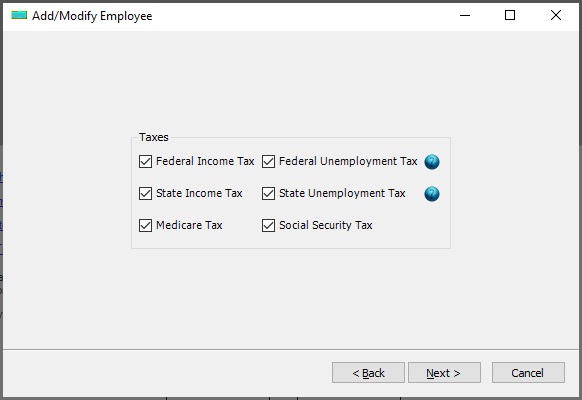

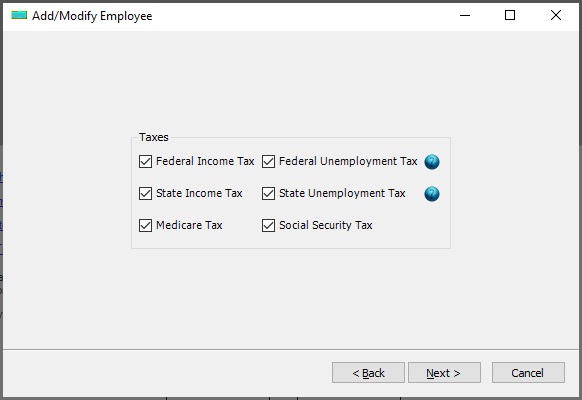

Issue #1: You did not check the FUTA and SUTA option on employee settings screen

You can edit the employee tax option to solve this issue.

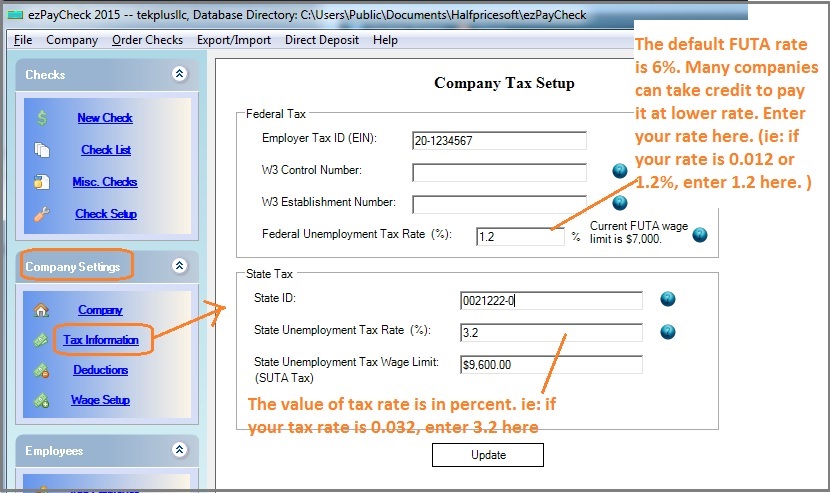

Issue #2: Wrong FUTA and SUTA Set up

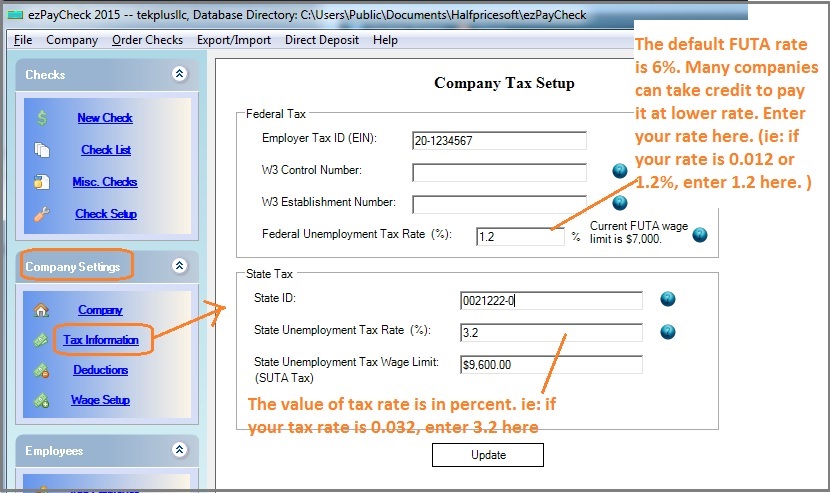

Click the left menu "Company Settings" then click the sub menu "Tax Information" to open the company tax setup screen. You can enter the FUTA and SUTA rate there.

When you add a new paycheck, ezPaycheck payroll software will use this new tax rate to withhold FUTA and SUTA.

The change of FUTA or SUTA rate will NOT affect existing paychecks.

Issue #3: The employee' payment exceeds the annual limit

For example: in 2020, the FUTA tax applies to the first $7,000.

Issue #4: Report option

For example: paycheck #1234, pay period 9/16/2020 to 9/30/2020, paycheck date 10/1/2020

If you select "Pay Ending Date" option, this check is the last paycheck of 3rd quarter.

If you select "Pay check date" option, it is the first paycheck of 4th quarter.

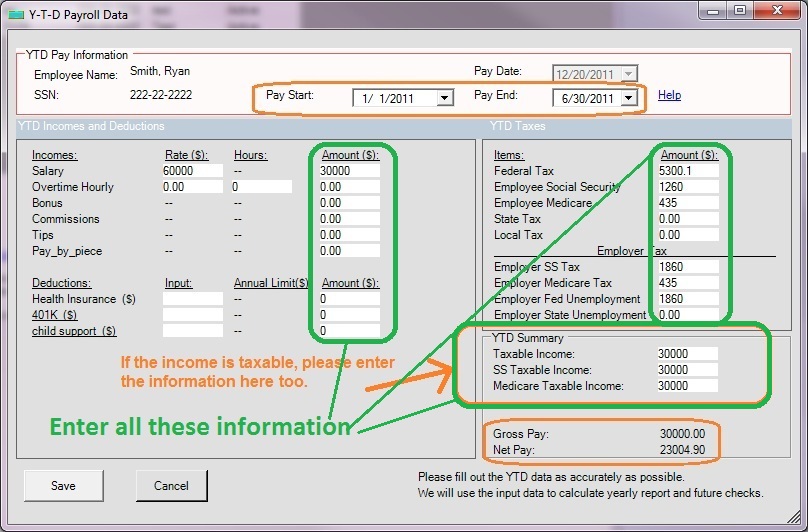

How to edit the report option Issue #5: New user: incorrect manual YTD data

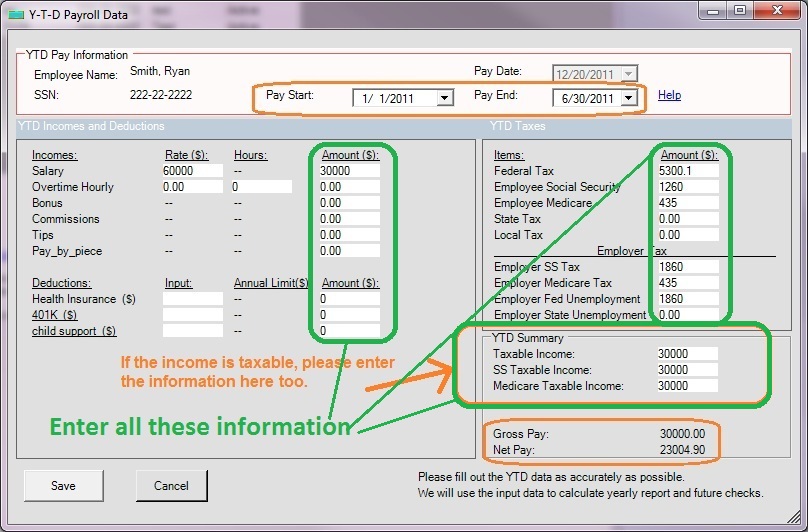

When you enter the YTD data, please make sure you entered data for Employer Fed Unemployment and Employer State Unemployement.

Start ezPaycheck in mid year: How to enter the YTD manually

Related Links:

ezPaycheck Quick Start Guide How a add a new company account How to handle both employees and contractors How to handle restaurant tips How to add a custom deduction and withhold it from each paycheck automatically How to handle local taxes How to handle State Disability Insurance (SDI) How to print paycheck in different formats: check-on-top, check-in-middle, check-at-bottom or 3-per-page How to print paycheck on blank stock How to print paycheck on pre-printed checks How to print paycheck with company logo How to adjust check printing position Sample Paychecks Determine a Company's Name for e-Filing

Download Now >

Buy Now